XRP Price Prediction: $5 Target in Sight as Institutional Demand Grows

#XRP

- Technical Strength: Price holding above 20-day MA with Bollinger Band squeeze suggests impending volatility

- Institutional Catalysts: ETF filings and Ripple-SEC resolution could unlock 40-60% upside

- Risk Factors: MACD divergence and token release volatility may delay breakout timing

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Amid Consolidation

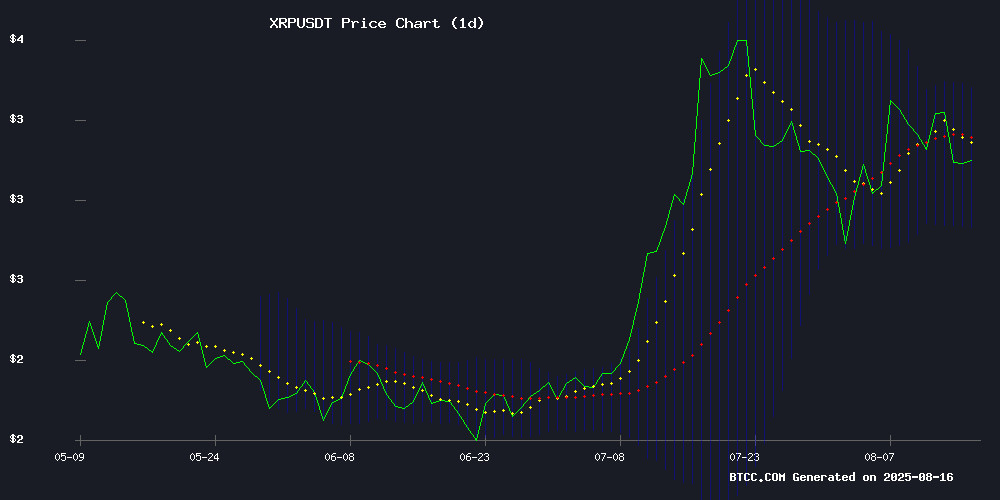

XRP is currently trading at $3.1022, slightly above its 20-day moving average (MA) of $3.1012, indicating a neutral-to-bullish bias. The MACD histogram shows a slight bearish crossover (-0.0297), but the signal line (0.0500) remains positive, suggesting potential upside momentum. Bollinger Bands reveal price consolidation, with the upper band at $3.3684 and lower band at $2.8339. According to BTCC financial analyst William, 'A sustained hold above $3.10 could trigger a retest of the upper Bollinger Band, with $3.37 as the next resistance.'

XRP Market Sentiment: Institutional Demand Fuels Optimism

News headlines highlight strong institutional interest in XRP, with ETF filings, adoption by a Nasdaq-listed company, and the nearing conclusion of the Ripple-SEC lawsuit. BTCC analyst William notes, 'Whale accumulation and regulatory clarity are key drivers. The $3.10 support level has held despite token release volatility, reinforcing bullish sentiment.' Targets of $4.67 and $5 are gaining traction among analysts, though William cautions, 'The MACD divergence suggests short-term consolidation before a potential breakout.'

Factors Influencing XRP’s Price

XRP Price Today: Whale Activity Signals Strategic Accumulation Amid Correction

XRP hovers near $3.10 after retreating from last week's $3.35 peak, with whale purchases totaling 440 million tokens ($3.8 billion) cushioning the drop. Institutional demand suggests this dip represents accumulation rather than sustained weakness.

On-chain metrics reveal whales absorbed 120 million XRP during August 15's $10 billion market sell-off. Exchange reserves are declining while large wallets grow—a historical precursor to price stabilization.

The cryptocurrency maintains a $308 billion fully diluted valuation despite shedding $15 billion in market cap since August 8. Trading volumes contracted 36% to $7.55 billion, reinforcing the accumulation thesis.

Technical charts show a symmetrical triangle forming on 4-hour timeframes, often preceding breakout moves. Market structure mirrors previous corrections where whale inflows preceded rallies.

XRP Targets $4.67 as Institutional Demand Fuels Bullish Momentum

XRP has demonstrated resilience in August, trading steadily at $3.11 despite broader market volatility. The token remains firmly above its $3.02 support level, with a recent peak of $3.35 last week. Whale activity has surged, with 440 million XRP acquired in the past week alone—including a notable 120 million token purchase during a market-wide sell-off on August 15.

Technical indicators and sustained accumulation by large holders suggest significant upside potential. Institutional demand appears to be outweighing retail selling pressure, reinforcing long-term confidence in the asset. Market observers are watching whether this accumulation phase will translate into continued price appreciation.

XRP: Institutional Money Flows Back In Amid Market Uncertainty

XRP resurfaces as a focal point in crypto markets following the resolution of its protracted legal battle with the SEC. Institutional investors are quietly accumulating positions, yet the landscape remains volatile—$59.3 million in liquidations rattled derivatives markets in recent days.

The August 7th 4% price surge to $3.25, accompanied by 140 million tokens traded, signals renewed institutional interest. Analysts debate whether current price oscillations represent a tactical correction or strategic repositioning, as technical indicators show conflicting signals near critical thresholds.

XRP Price Prediction: XRP Holds $3.10 Amid Liquidations—Analyst Maps Road to $5

XRP demonstrates resilience as whale accumulation during recent sell-offs fuels optimism. Institutional demand, ETF speculation, and Ripple's expanding utility are seen as catalysts for a stronger rally.

Despite a pullback, late-session buying pushed XRP back above $3.10. Blockchain data reveals a 38% drop in trading volumes post-sell-off, suggesting exhaustion of forced selling. Large holders capitalized on the dip, treating it as a buying opportunity rather than a signal of further weakness.

A bullish flag pattern on XRP's daily chart hints at potential upside. Bitget Crypto Signals notes this technical setup could propel prices toward $5 if momentum holds above $3.05 support.

Full List of XRP Spot ETFs Filings, Deadlines, and What’s Next

The U.S. Securities and Exchange Commission is actively reviewing multiple XRP ETF applications, with most pending final decisions. Regulatory clarity has improved following the dismissal of the Ripple lawsuit, restoring optimism for approval.

ProShares Ultra XRP ETF, filed on January 17, 2025, received SEC approval for listing on NYSE Arca in mid-July 2025. The ETF launched on July 18, offering 2x leveraged exposure to XRP futures.

Grayscale XRP ETF's application, submitted on November 21, 2024, seeks to convert its XRP Trust into an ETF. A final SEC decision is expected by October 18, 2025.

21Shares XRP ETF filed on the same date aims to list Core XRP Trust shares on Cboe BZX Exchange. The SEC acknowledged the application on February 19, with a verdict due by October 19, 2025.

Bitwise's December 2, 2024 filing proposes a spot XRP ETF holding XRP directly. The SEC acknowledged this application on February 19, setting an October 20, 2025 deadline for its decision.

Nasdaq-Listed Pharma Distributor Adopts XRP Ledger for Pharmacy Payments

Wellgistics Health Inc., a Nasdaq-listed pharmaceutical distributor, is leveraging the XRP Ledger (XRPL) to power a new payment system for thousands of independent pharmacies across the U.S. The platform aims to streamline drug inventory payments, enabling instant settlements while circumventing traditional banking delays and high credit card fees.

Integrated with RxERP, a pharmaceutical e-commerce system, the solution offers real-time tracking and cost savings. Wellgistics, which works with over 6,500 pharmacies and 200 manufacturers, is among the first healthcare firms to deploy XRPL at scale. CEO Brian Norton notes pharmacies have been surprisingly receptive to blockchain adoption.

The system complies with healthcare regulations including HIPAA, though Wellgistics hasn't disclosed whether participants must hold XRP directly or use fiat conversions. This move signals growing institutional adoption of blockchain solutions in regulated industries.

Ripple vs SEC Lawsuit Nears Conclusion with Joint Dismissal

The protracted legal battle between Ripple Labs and the U.S. Securities and Exchange Commission is effectively over after both parties filed a joint dismissal. Former SEC attorney Marc Fagel clarified that only administrative closure by the court clerk remains, stating "No judge approval is required. It's essentially over already."

The resolution marks the end of a landmark case that began in December 2020, with implications for cryptocurrency regulation. XRP's price showed volatility following the announcement, as Ripple executives publicly celebrated the outcome through official channels.

XRP Stabilizes at $3.12 as Regulatory Clarity Spurs Institutional Demand Amid Token Release Volatility

XRP trades at $3.12, up 0.51%, as the dismissal of appeals in the Ripple-SEC case removes a key regulatory overhang. Institutional interest surged, with daily volumes spiking 208% post-ruling, though profit-taking has tempered gains.

The release of 1 billion XRP ($3.28B) created short-term supply pressure, offsetting some bullish momentum. Market technicians note the neutral RSI at 51.71 leaves room for upward movement if institutional flows persist.

The Most Dangerous Meme in Crypto: XRPINU’s Disruptive Playbook

XRPINU is carving a unique niche in the crowded memecoin space, blending satire with structured execution. Unlike fleeting meme tokens, it adopts a startup-like roadmap while mocking crypto conventions—mimicking XRP’s branding with ironic twists and deploying cartoon mascots as cultural commentary.

The project’s technical rigor stands out: a 100 billion token supply, $1M locked liquidity, and a 15-tier presale governed by smart contracts. Its Q3-Q4 2025 plans include community campaigns and DEX listings, signaling intent to evolve beyond viral hype into a protocol with staying power.

XRP Set for a Major Rally: Will $3.70 Trigger the Next Bull Run?

XRP faces bearish momentum as it drops 0.32% to $3.11, with a 39% decline in trading volume. The token has fallen 5.5% over the past week, reflecting sustained downward pressure. Despite this, analysts remain optimistic about a potential breakout.

Crypto analyst Ali Martinez notes XRP is forming a triangle pattern, with a breakout above $3.26 potentially propelling it to $3.90. CoinCodeCap Trading identifies $3.50-$3.70 as a critical resistance zone. A decisive move past this level could target $3.85, $4.15, and $4.53.

Catalysts for upward movement include the potential dismissal of the SEC lawsuit and $400 million in corporate purchases. Market watchers are closely monitoring whether these factors can overcome current bearish sentiment and ignite a sustained rally.

Was Ripple vs SEC Just a Distraction? Analyst Claims US Ties

The protracted legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) may have been less about regulatory conflict and more about strategic positioning, according to crypto analyst Pumpius. The case, once portrayed as a defiant startup challenging a powerful regulator, now appears as a potential smokescreen for Ripple's global expansion under the guise of opposition.

Ripple's payment network—featuring instant settlement, negligible fees, and compliance with the ISO 20022 banking standard—aligns with institutional needs rather than retail adoption. "Ripple was never about retail," Pumpius asserts. "It was building the next-generation payment rails to potentially supplant SWIFT." The technology's design suggests deliberate integration with existing financial systems, not disruption.

Notably, Ripple's alleged ties to U.S. government and central bank initiatives lend credence to the theory. The SEC lawsuit may have provided cover while the company advanced infrastructure tailored for large-scale adoption by banks and cross-border payment providers.

How High Will XRP Price Go?

XRP's price trajectory depends on both technical and fundamental factors. Below is a summary of key levels and catalysts:

| Key Level | Price (USDT) | Significance |

|---|---|---|

| Support | 3.10 | 20-day MA & liquidation defense |

| Resistance | 3.37 | Upper Bollinger Band |

| Target 1 | 3.70 | Breakout trigger for bull run |

| Target 2 | 4.67 | Institutional demand projection |

| Target 3 | 5.00 | Post-lawsuit FOMO scenario |

BTCC's William emphasizes: 'The $3.70 level is critical—a weekly close above it could accelerate gains toward $5, especially with ETF approvals pending. However, traders should watch MACD for confirmation of renewed bullish momentum.'